Life Insurance in and around Huntley

State Farm can help insure you and your loved ones

What are you waiting for?

Would you like to create a personalized life quote?

- Huntley

- Gilbert

- Union

- Lake in the Hills

- Marengo

- Algonquin

- Belvidere

- Palatine

- Inverness

- Barrington

- South Barrington

- Barrington Hills

- Village of Lakewood

- Rolling Meadows

- Rockford

- Arlington Heights

- East Moline

- Dixon

- Grafton

- Elkhart Lake

- Schaumburg

- Hoffman Estates

- Kildeer

- Deer Park

It's Time To Think Life Insurance

Think you are too young for life insurance? Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Huntley, IL, friends and neighbors of all ages already have State Farm life insurance!

State Farm can help insure you and your loved ones

What are you waiting for?

Huntley Chooses Life Insurance From State Farm

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the cost associated with financially supporting children, life insurance is an extreme necessity for young families. Even if you or your partner do not have an income, the costs of paying for daycare or before and after school care can be excessive. For those who aren't parents, you may have a partner who is unable to work or have debt that your partner will have to pay.

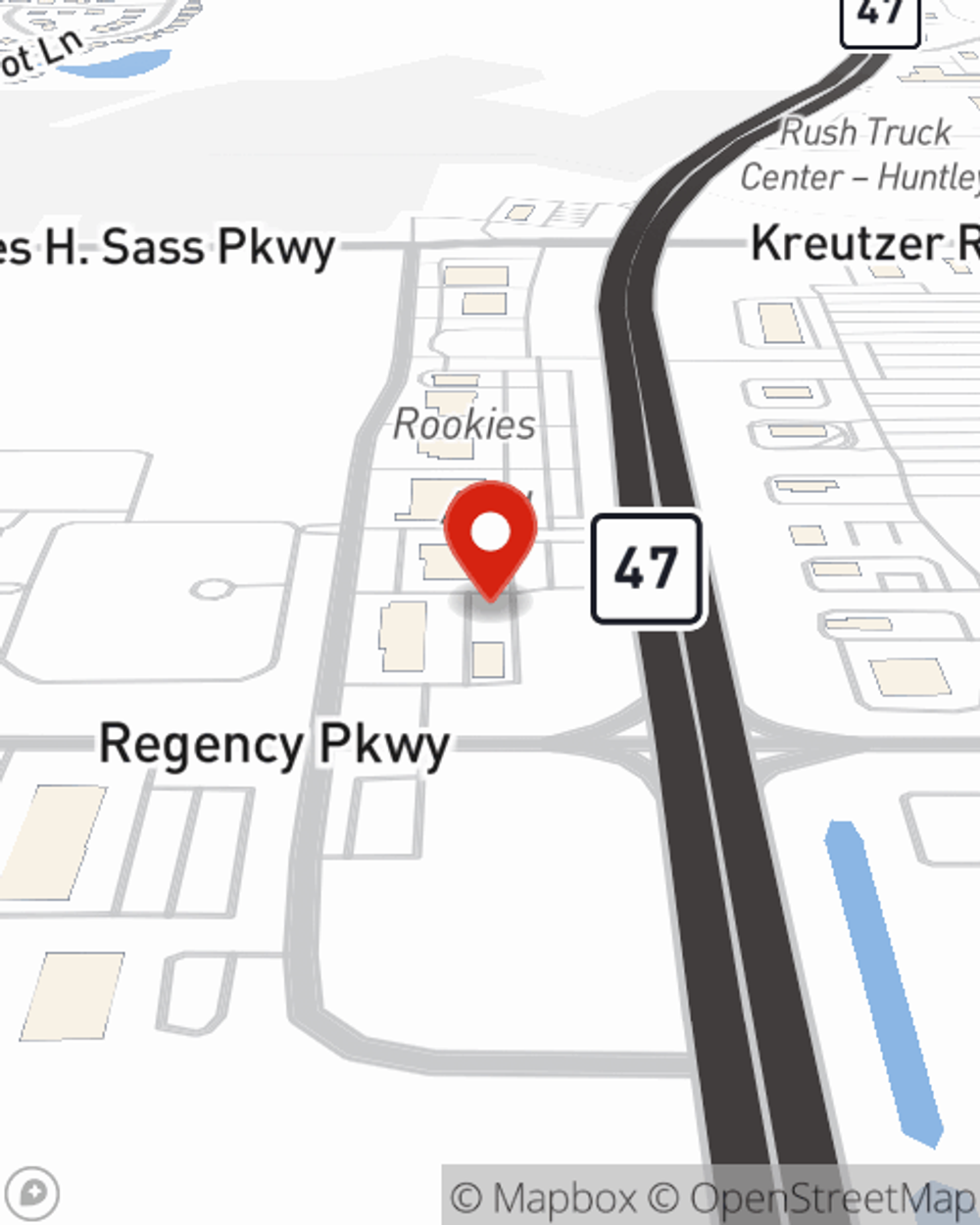

As a leading provider of life insurance in Huntley, IL, State Farm is ready to protect those you love most. Call State Farm agent Chad Radtke today for a free quote on a life insurance policy.

Have More Questions About Life Insurance?

Call Chad at (833) 480-0200 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Chad Radtke

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.